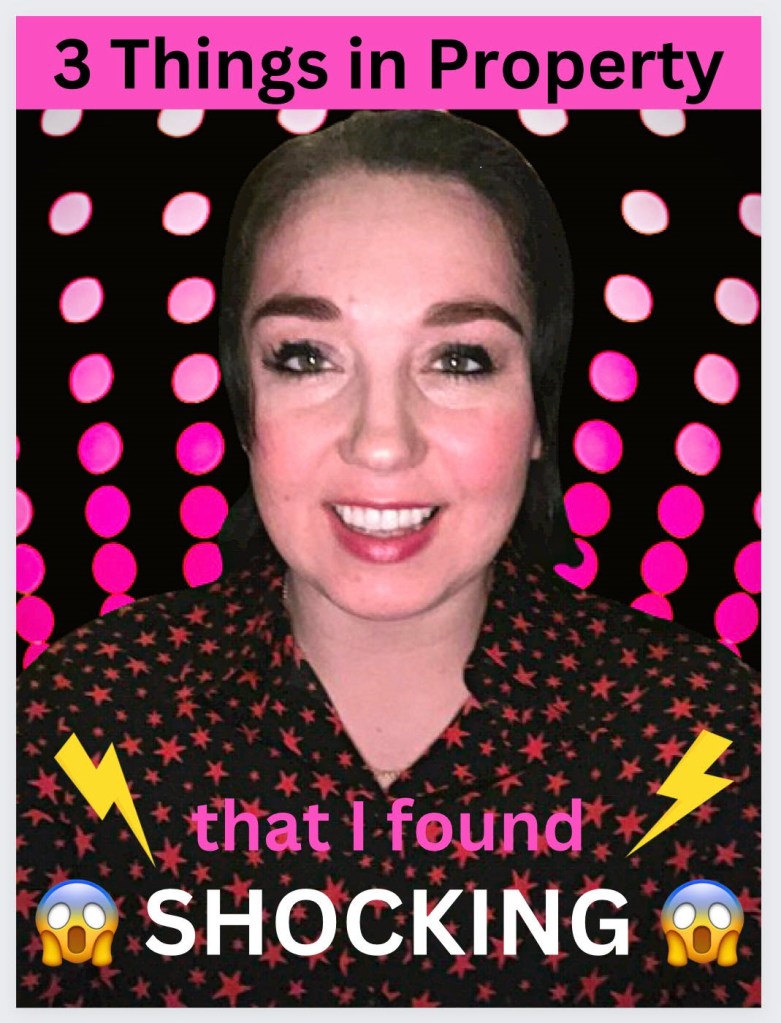

1. Never buy a house I wouldn’t live in myself

A nice simple self-explanatory rule to start with!

With all my houses, even the ones in the less popular areas of the city, I would still be content to live in them myself if I had to. Because if I’m not prepared to live in the homes I’ve created, why should I expect anybody else to?

If the street or area is rough and ropy or unsafe, or the house is not refurbished well enough, then it’s not suitable for customers / tenants / people. And if I think it’s not good enough for me, it’s not good enough for others either.

2. Only buy houses within 20 minutes from my front door

I’m Leeds born and bred, and have lived here all my life. Whilst I can understand the appeal that some other investors have about buying property in different areas all over the country, that’s just not for me.

My goal was always to provide local homes for local people in my home town.

And because my houses are relatively close, I can visit them easily, or get there quickly if there’s an emergency to deal with.

3. Ensure the property cashflows a minimum £250 net profit from the rent per month

From a monetary business aspect, each house must create positive cashflow every month after the mortgage has been paid.

It astounds me to hear of landlords where the rental income only just covers the property’s buy-to-let mortgage.

Or even worse – the mortgage is more than the rent, so the landlord is effectively paying for a tenant to live there!

Make sure you make money from each property, or you may end up in debt, stress, and trouble.

Another key property business mistake to avoid is this: don’t get too emotionally attached to the houses either – it’s a business, so they are effectively just boxes that you make money from.

As long as you maintain and look after your boxes and their contents (people included!) all should be well.

4. Have the potential to add at least £25k to the end value

Buying houses below market value is not always easy. But that’s the way my business model works. I’ve got to be able to uplift the value via refurbishment to be able to pull out mine and my investors’ money when the property is revalued, after all the work is complete. So you need to be realistic when checking end values and ceiling prices of the rest of the comparable houses nearby.

Be cautious when researching likely end property values, so take your cheerful rose-tinted glasses off!

Here’s one of the very few places in life where it’s better to be cautiously pessimistic / realistic in the financial figures rather than overly optimistic.

5. Don’t deal with dickheads

There’s no other way to phrase this nicely.

Some people will just cause you chaos, stress, anxiety, and cost you time, money, effect and energy.

There’s lots of lovely people, tenants, contractors, and professionals around…So we don’t need to waste our time with unscrupulous and unsuitable people who just do not respect us. (And this means people in our personal life who behave in stupid ways too!!)

They may be rude or disrespectful or patronising to you, not do as good a job as they promised, trash your house, lie to you, and generally cause you a headache. The key is being able to spot these types of people before you engage with them.

Which leads us to…

6. Use your gut instinct when working with other people

Spotting genuinely good people from those who just pretend to be, is difficult.

I’ve had a plasterer that promised me he was awesome – then walked off the job because he couldn’t get his plaster to stick to the ceiling.

I’ve had a HMO tenant be such a charming manipulative liar that he lied to my face with ease – only to then stop paying rent, and become an avoidant problematic bullshitter.

I’ve had a tenant wanting a fresh start of stability from her chaotic past and provide a secure home for her children – only to repeat her same mistakes, get involved with drugs and violent boyfriends and utterly trash my house and abscond leaving a horrendous and expensive mess for me to deal with.

The common factor in these, and every case I’ve had which has turned out badly, is that every time, I had a niggling feeling in my gut that something wasn’t right about these people.

But I chose to ignore that uncertainty I felt and gave them a chance anyway, because I try to be nice like that, and trust that they won’t let me down with their chance.

I don’t do that anymore.

If my gut instinct tells me something isn’t right about something or someone – I believe it.

7. A void is better than a headache

Following on from my last point, if your gut instinct tells you someone will not make a suitable tenant in your property, wait until you find one that is.

There’s plenty of people around needing housing, so we shouldn’t be so desperate to grasp rental money that we end up putting someone unsuitable in our properties.

Not only because if / when it all goes wrong, it’s then very difficult to get rid of them, especially if you have to go down the costly eviction route.

Do stringent checks on your potential tenants, and if someone’s not right or you just don’t get a good feeling about them, say no.

It really is better to have a void than a headache.

I’ve left rooms and properties empty for weeks and weeks sometimes, because I haven’t been totally happy about potential tenants that have viewed them.

The right tenant is worth waiting for.

You’re looking for long term stability and reliability in your tenants, not just filling your wallet with short term cash.

8. Avoid false economy during refurbishments

It may seem like a good idea at the time, not doing certain things during refurbishments to save time or money – but it is false economy in the long run.

Examples I have made like this which taught me this lesson include:

⁃ Not putting radiators in kitchens. Only to then later have to retrofit electric heaters.

⁃ Not replacing the old gutters at the same time as having a new roof done. Only to then have to replace them a few years later – and the majority of the cost was having to put scaffolding up again.

⁃ Buying cheap poor quality boilers – only to then have to replace them way before the usual boiler lifespan because they went kaput.

Better to do big jobs all at once during the refurb, rather than kicking the can down the road to have to deal with at a later time – and likely with more expensive retrofitting or replacement costs.

9. Be a good person

Unfortunately there are a lot of wretches in this industry.

They talk a good game, give a nice winning smile, extort money from people… only to then do them wrong or rip them off for vast amounts of money. Eventually though, all these wretches get found out, and rightly so.

Because it’s not enough to just PRETEND to be a good person – you’ve got to actually BE a good person.

And that means caring about other people, rather than taking advantage of them for your own selfish needs.

So be understanding when your tenant is genuinely struggling.

Pay your contractors’ invoice swiftly when they have already completed the work for you.

Repay your investors in full and on time – and if there’s a problem, be open and honest about it, and work hard to get it resolved.

Things do sometimes go wrong – in projects and in life – but radio silence and lack of communication just causes mistrust and makes things worse.

My final thought on this topic is one personal life rule I live by:

Don’t ever say anything or do anything or behave in a way that would make your favourite grandma ashamed of you.

Your Nanna and your conscience are watching – so don’t let them down, and do yourself proud.

10. Have great integrity and do what you say you will do

Last one, which is a nice follow on from the previous rule.

It surprises and appals me how many people in life don’t actually do what they say they will do. I think if you do have great integrity, you really are in the minority of people.

You wouldn’t believe the amount of people I book tenancy viewings or meetings for, who don’t even turn up.

They don’t appear, they don’t call, they don’t do the thing they agreed to. It tells me a lot about that person.

And an unreliable, untrustworthy, flaky person of poor integrity is not the sort of reputation you want other people to have about you.

Having great integrity is always doing the right thing – even when no one is watching.

So those are my own personal ten rules of property investing – and as you’ve seen, it’s not just about the tangible bricks and mortar aspect of it!

Best of luck with building your own property portfolio, because it’s not easy.

Because if it was, everyone would do it…

Wouldn’t they…?!?

Kellyann Martin is a UK-based property investor.

She has a book available for purchase on Amazon, click here to buy:

STARTING OUT IN PROPERTY…: What I Wish I’d Known At The Beginning! : Martin, Kellyann: Amazon.co.uk: Books

You must be logged in to post a comment.